It’s A Good Time For Both Paid Media Viewership & Cost Efficiency

April 9, 2020

By Stephen Szostak & Chris Georgia

Supply & Demand

Ask any high school junior stuck studying economics from home and they will tell you what happens when supply jumps and demand slumps: prices decrease. The advertising landscape is no different.

Digital

One of the many effects of COVID-19 has been a skyrocketing supply of online inventory. The increase has been so significant, that it recently prompted Facebook CEO Mark Zuckerberg to say, “We’re just trying to keep the lights on over here.”

At the same time, the demand for this inventory has plummeted as advertisers big and small pull back their advertising budgets and consumers tighten their belts.

The result? The last three weeks have seen some of sharpest price declines in years, both for acquisition and persuasion advertising. Cost per acquisitions (CPAs) for clients have dropped by 50 to 75 percent, with some acquisition activities costing closer to pennies than dollars. On persuasion, the story is the same. Looking at a sampling of advertisers, the cost for a 15-second view on Facebook has dropped by 60 percent.

Television

The increased media engagement trend is also being seen on television, where audiences are increasing, but rates are not. Like digital, demand from television advertisers has decreased due to market uncertainty, while viewing in the category has seen unprecedented growth.

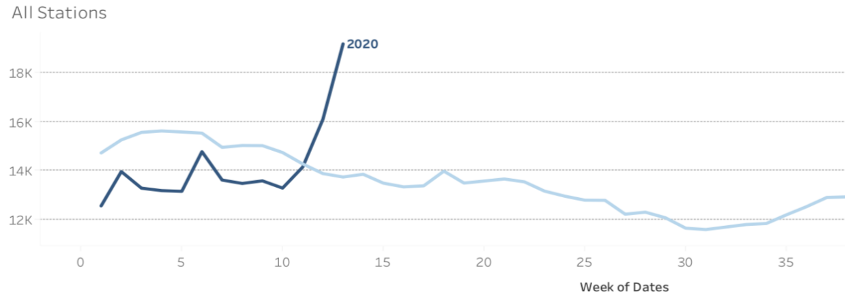

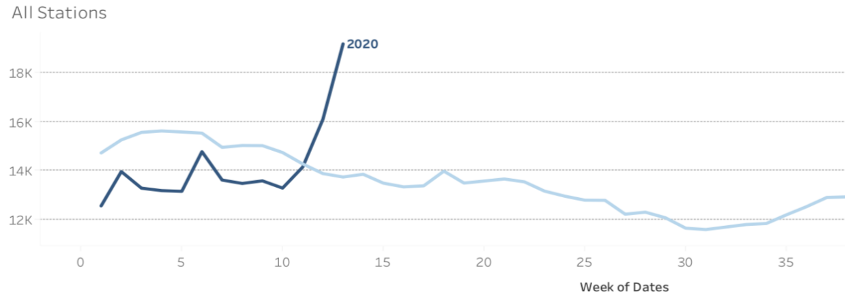

Analyzing Comcast set top box data from March 18 to 24 in their top markets, we see double digit growth in live television viewing year-over-year in just about every market. For example, Houston, Atlanta, Detroit and Chicago are all up 15 percent with Boston, Minneapolis and Denver not far behind. More specifically, recent data suggests broadcast television viewership is also up over 10 percent. We reviewed ratings trends from large ownership groups, such as Tegna and Scripps, for a closer look. Their data shows household weekly program impressions up as much as 30 percent year-over-year on the broadcast stations in Scripps TV markets. We also see an increase in ratings of 20 percent plus among A35+ audiences in evening news on the Tegna stations in Phoenix, Denver, Charlotte and Dallas. It is rare to see growth of this level on broadcast, especially given that there are no live sporting events to drive these numbers. In any given year, March Madness would likely be leading the television conversation as the big event to end the first quarter. To see growth without it is even more astounding.

via Scripps

via Scripps

So which television category is leading the way with the highest audience increases? The answer appears to be news. Cable news is way up. Set top box data shows cable news has seen the biggest growth of any television category. Across 25 markets analyzed, viewership was up an average of 100 percent, or double, in comparison to the same week a year ago. Given the increased evening news ratings on broadcast mentioned earlier and this cable news data, it is clear that Americans are watching more live television and news appears to be the major driver. Yes, other day parts are seeing an increase, but news is currently out pacing all other categories.

As may be expected, television usage is also up for time shifted and connected viewing. Comcast is seeing dramatic growth on Video-On-Demand viewing, with most markets experiencing growth closer to 50 percent year-over-year. This is a telling sign that other Connected TV (CTV) / Over-The-Top (OTT) platforms are also experiencing large lifts in viewership. As supply for this category continues to increase, it provides scalability to help achieve stronger message reach on the platform. An informed media mix utilizing live television and CTV / OTT has an even stronger potential to achieve reach levels not achievable in the past.

Staying on top of viewership trends is key to our recommendations for the coming months and into the fall. We are tracking changes in how people are consuming media and the costs associated with each medium to maximize efficiencies in an audience-based integrated plan.

Back